What Does “Millennials Own Homes” Really Mean?

The phrase millennials own homes refers to the growing number of people born between the early 1980s and mid-1990s who have entered the housing market as property owners.

For years, millennials were described as a generation stuck in rentals. Today, that perception is changing. As millennials move into their 30s and 40s, homeownership rates naturally increase. Age plays a major role in understanding the data. Older millennials are far more likely to own homes compared to those in their 20s.

The important takeaway is simple: the delay in buying does not mean rejection of homeownership. It reflects timing, economic pressure, and financial preparation.

Why Millennials Started Buying Homes Later

Millennials came of age during challenging financial periods. Economic recessions, job instability, and rising student debt shaped their early adulthood. Many focused first on building stable careers and reducing debt before committing to property purchases.

Unlike previous generations who often bought homes in their 20s, millennials typically waited until their early or mid-30s. This shift created the impression that they were avoiding homeownership. In reality, they were prioritizing financial readiness.

Major Housing Trends Among Millennials

1. Later First-Time Home Purchases

Millennials prefer entering the housing market when income feels secure. Saving for a larger down payment and maintaining emergency funds has become common practice. Financial confidence comes before ownership.

2. Move Toward Affordable Locations

Instead of competing in expensive city centers, many millennials explore suburban communities and smaller cities. These areas offer better value, larger living spaces, and long-term growth potential.

3. Remote Work Reshaping Housing Choices

Flexible work models allow millennials to choose homes based on lifestyle rather than office proximity. Space, comfort, and affordability often matter more than living near downtown business districts.

4. Smaller but Smarter Homes

Modern buyers prioritize functionality. Energy efficiency, smart home systems, and practical layouts are more attractive than oversized properties with higher maintenance costs.

5. Investment-Focused Decision Making

Millennials frequently analyze resale value, neighborhood growth, and rental potential before buying. A home is not just shelter. It is viewed as a long-term financial asset.

From Renting Generation to Property Owners

The narrative that millennials prefer renting permanently is outdated. Early adulthood was shaped by high rent costs, student loans, and career uncertainty. As income stability improves, ownership becomes realistic.

The transition from renting to owning is steady and intentional. Millennials may not rush into the market, but when they buy, they do so with planning and research.

Understanding the Age Gap in Millennial Homeownership

Not all millennials are in the same life stage. Younger millennials are still building careers, while older millennials are entering peak earning years.

This age range explains why ownership statistics vary. When broken down by age group, the numbers show a clear upward trend in homeownership as millennials grow older.

Delayed But Not Denied: A Strategic Shift

Millennials did not abandon homeownership goals. They adjusted their timeline.

Financial instability in early adulthood encouraged caution. Rather than making rushed decisions, many chose to strengthen their financial base first. This strategic delay reflects long-term thinking, not disinterest.

Affordability Challenges and Smart Financial Planning

Modern housing markets are expensive. Rising property prices and mortgage rates require careful planning.

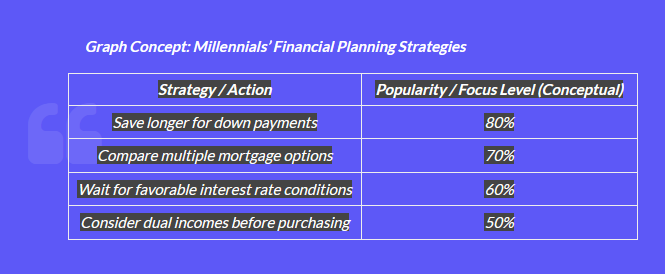

Millennials often:

-

Save longer for down payments

-

Compare multiple mortgage options

-

Wait for favorable interest rate conditions

-

Consider dual incomes before purchasing

This calculated approach reduces financial risk and increases long-term security.

Lifestyle Preferences Shaping Millennial Homes

Millennials value balance. Flexible careers and digital work influence housing priorities.

Instead of nightlife access or city-center prestige, many prioritize:

-

Home office space

-

Safe communities

-

Outdoor areas

-

Lower living costs

Housing decisions reflect evolving life goals rather than traditional expectations.

Technology and the Digital Buying Experience

Millennials are highly research-oriented buyers. They use online platforms to:

-

Compare property prices

-

Study neighborhood trends

-

Estimate mortgage payments

-

Attend virtual tours

Access to data empowers them to negotiate confidently and avoid impulsive purchases.

The Wealth-Building Perspective

Homeownership is increasingly viewed as a financial foundation. Millennials understand equity growth and long-term appreciation.

Many buyers evaluate:

-

Future resale value

-

Rental income possibilities

-

Market demand in specific areas

This mindset positions property ownership as a strategic investment rather than simply a lifestyle upgrade.

Key Insights About Millennials and Homeownership

-

Millennials are a dominant force in first-time home purchases

-

Ownership rates rise significantly with age

-

Student debt delayed entry but did not eliminate ownership goals

-

Remote work expanded affordable location choices

-

Financial strategy defines modern millennial buyers

Common Questions About Millennials Owning Homes – Explained

The topic of millennial homeownership sparks a lot of curiosity because this generation is reshaping the housing market. People want to know not just if millennials own homes, but how many, why, and when. Let’s break down the most common questions and what they really mean.

1. What Percentage of Millennials Own Homes

This is the most frequently asked question. Homeownership varies within the generation depending on age, income, and location. Older millennials, who are in their late 30s and early 40s, show much higher ownership rates than younger millennials in their late 20s.

The percentage indicates not only current ownership but also reflects the long-term financial trends and priorities of the generation. Understanding this helps analysts, real estate developers, and policy makers forecast housing demand and tailor housing solutions.

2. How Many Millennials Own Homes

While percentages provide context, many people also want the raw numbers. This helps answer the question: “How big is this generation’s impact on the housing market?”

The total number of millennial homeowners is now in the tens of millions in the United States alone. As the largest generational cohort entering adulthood, their influence on property trends, mortgage markets, and first-time buyer programs is substantial.

3. Are Millennials Buying Homes Faster Now

Many want to know if millennials are accelerating their home purchases after early delays. The answer is yes, but with strategy. Millennials buy later than previous generations but do so more deliberately.

Factors like rising rental costs, remote work flexibility, and a desire for financial stability are pushing millennials to enter the market at higher rates than before. This trend affects real estate sales, urban development, and mortgage demand.

4. Why Did Millennials Delay Buying Property

Delays in buying homes are often misunderstood. Millennials did not reject property; they faced economic challenges that previous generations rarely experienced.

Key reasons include:

-

High student loan debt affecting borrowing power

-

Rising home prices outpacing income growth

-

Economic recessions reducing job security

-

Desire for career mobility and lifestyle flexibility

This delay is less about unwillingness and more about strategic financial planning. Millennials waited until they could buy smartly, with stability and investment potential in mind.

Why These Questions Are Trending

Millennials now drive a large portion of the housing market, particularly for first-time home buyers. As they make financial decisions differently than older generations, people naturally want insight into:

-

How their buying patterns differ

-

What percentage are actually achieving homeownership

-

How their strategies impact the housing market

These common questions help both buyers and sellers understand trends, plan investments, and predict where the housing market is headed next.

The Real Story Behind Millennials Own Homes

Public discussion once framed millennials as financially irresponsible or uninterested in long-term commitments. That narrative oversimplified reality.

Millennials entered adulthood during economic uncertainty. Instead of rushing into homeownership, they chose preparation. They built careers, reduced debt, and strengthened savings before purchasing property.

Today’s millennial buyers are data-driven and cautious. They analyze markets, review mortgage structures, and plan for future flexibility. A home serves multiple roles: residence, workspace, and potential investment asset.

The phrase millennials own homes now reflects a growing trend rather than a surprising exception. What changed is not desire, but conditions and strategy.

Millennial homeownership is not disappearing. It is evolving into a smarter, more financially informed approach to property ownership.